For ambitious entrepreneurs and global investors, Panama has long been more than just a country with a famous canal. It’s a thriving business hub where opportunity meets efficiency, offering a unique blend of strategic location, economic stability, and an investor-friendly climate. Whether you’re launching a startup or expanding an existing enterprise, Panama presents a compelling case for business success.

A Global Trade Hub with Economic Strength

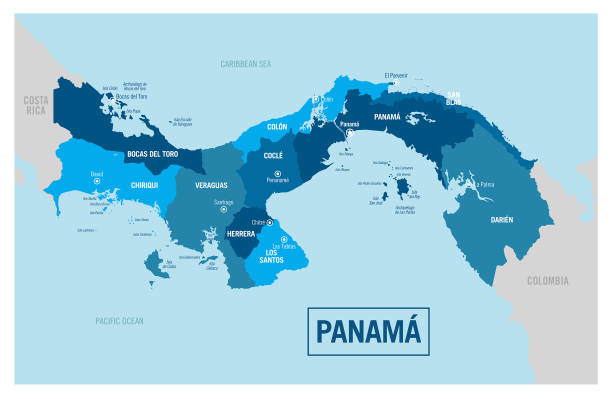

Panama’s geographical advantage is impossible to overstate. Situated at the crossroads of international trade, the country serves as a natural bridge between North and South America, with the Panama Canal playing a central role in global commerce. This logistical advantage makes it a powerhouse for international shipping, trade, and commerce, attracting multinational corporations and logistics giants alike.

Beyond its location, Panama’s economy remains one of the most stable in Latin America. With a dollarized economy, low inflation, and strong GDP growth, businesses operating here enjoy a predictable financial environment. Unlike countries with volatile currency fluctuations, Panama’s economic policies provide consistency, making it an attractive destination for investors who value long-term stability over short-lived incentives.

A Business-Friendly Tax System and Seamless Company Registration

Panama’s tax policies are among its strongest draws for foreign entrepreneurs. The country operates under a territorial tax system, meaning income earned outside its borders is not subject to local taxation. For international businesses, this translates into significant cost savings and simplified accounting. Unlike jurisdictions with complex global taxation models, Panama’s approach is straightforward, allowing companies to focus on growth rather than navigating cumbersome tax codes.

Setting up a business here is refreshingly efficient. The panama company registration process is streamlined, with minimal bureaucratic hurdles and a relatively fast turnaround time. Whether forming a corporation or an LLC, entrepreneurs can structure their businesses to suit their specific needs while benefiting from Panama’s favorable legal framework.

Confidentiality, Asset Protection, and Legal Advantages

Panama is widely recognized for its strong legal protections, particularly when it comes to corporate confidentiality. Unlike some jurisdictions where shareholder and director information is publicly accessible, Panama’s laws ensure a high degree of privacy.

In addition to confidentiality, Panama offers robust asset protection mechanisms. The legal framework allows businesses to hold assets securely, safeguarding them from excessive taxation, political instability in other countries, or legal disputes. These protections, combined with a business-friendly regulatory environment, make Panama a stronghold for wealth preservation and corporate security.

Panama’s appeal goes beyond tax advantages and easy company formation. It’s a country where businesses can thrive, leveraging a global trade network, economic resilience, and investor-friendly laws. For those looking to establish an international presence, Panama remains one of the most compelling choices in today’s business landscape.